Succentrix Business Advisors for Dummies

Succentrix Business Advisors for Dummies

Blog Article

9 Simple Techniques For Succentrix Business Advisors

Table of ContentsLittle Known Questions About Succentrix Business Advisors.Excitement About Succentrix Business AdvisorsSuccentrix Business Advisors Fundamentals ExplainedThe Ultimate Guide To Succentrix Business AdvisorsSuccentrix Business Advisors Can Be Fun For Everyone

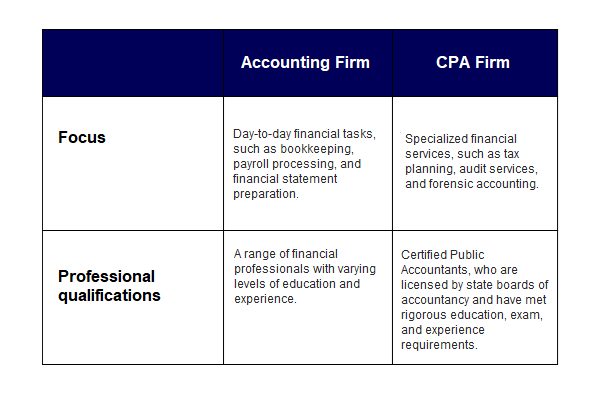

Getty Images/ sturti Contracting out accounting solutions can free up your time, prevent errors and even reduce your tax obligation bill. However the dizzying selection of options may leave you baffled. Do you require a bookkeeper or a state-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT)? Or, possibly you desire to handle your general accounting jobs, like accounts receivables, yet hire an expert for capital forecasting.Discover the various kinds of accounting solutions readily available and discover exactly how to select the best one for your little company needs. Audit services drop under general or financial audit. General audit describes normal responsibilities, such as taping transactions, whereas monetary accountancy prepare for future growth. You can work with a bookkeeper to enter data and run records or work with a CPA that offers monetary guidance.

Prepare and file tax obligation returns, make quarterly tax obligation settlements, file expansions and take care of IRS audits. Generate economic declarations, consisting of the equilibrium sheet, earnings and loss (P&L), cash flow, and earnings declarations.

The Definitive Guide to Succentrix Business Advisors

Track work hours, calculate wages, hold back taxes, concern checks to employees and guarantee precision. Audit solutions may also consist of making payroll tax obligation payments. In addition, you can work with professionals to make and establish up your bookkeeping system, give economic preparation guidance and explain economic statements. You can contract out chief monetary policeman (CFO) solutions, such as succession preparation and oversight of mergers and procurements.

Often, tiny business owners outsource tax services first and include payroll support as their business grows., 68% of respondents make use of an exterior tax obligation practitioner or accountant to prepare their company's tax obligations.

Next off, it's time to find the appropriate audit solution company. Now that you have a concept of what type of audit solutions you need, the inquiry is, that should you hire to offer them?

4 Easy Facts About Succentrix Business Advisors Described

Before making a decision, take into consideration these concerns: Do you want a regional audit specialist, or are you comfy functioning practically? Should your outsourced solutions integrate with existing accountancy tools? Do you need a mobile application or on-line site to manage your audit solutions?

Use for a Pure Fallen Leave Tea Break Grant The Pure Leaf Tea Break Grants Program for tiny organizations and 501( c)( 3) nonprofits is now open! Ideas can be brand-new or currently underway, can come from Human resources, C-level, or the frontline- as long as they enhance worker wellness through society modification.

Something failed. Wait a moment and try once again Attempt once more.

Advisors supply why not look here beneficial insights into tax obligation methods, guaranteeing companies decrease tax responsibilities while abiding by intricate tax laws. Tax preparation includes proactive actions to enhance a firm's tax placement, such as reductions, credit histories, and incentives. Maintaining up with ever-evolving accounting requirements and regulatory demands is essential for organizations. Bookkeeping Advisory specialists assist in economic reporting, making sure accurate and compliant economic statements.

Some Known Details About Succentrix Business Advisors

Below's a thorough check out these important skills: Analytical skills is an essential skill of Bookkeeping Advisory Services. You must be skillful in celebration and assessing monetary data, drawing meaningful insights, and making data-driven referrals. These abilities will enable you to analyze financial efficiency, recognize patterns, and offer educated guidance to your customers.

Interacting efficiently to customers is a crucial skill every accounting professional should have. You need to be able to share complex economic information and understandings to clients and stakeholders in a clear, understandable way. This includes the capability to convert monetary jargon right into plain language, produce comprehensive reports, and supply impactful discussions.

Get This Report on Succentrix Business Advisors

Audit Advisory firms use modeling methods to simulate different monetary circumstances, analyze potential results, and assistance decision-making. Effectiveness in monetary modeling is crucial for accurate forecasting and calculated preparation. As an accounting advisory firm you should be skilled in monetary regulations, bookkeeping standards, and tax laws relevant to your clients' sectors.

Report this page